Here is the web site URL: OnlineTitleLoans.co. This platform offers a streamlined course of action for getting

Knowing Title Financial loans

Rapid Access to Cash: Title financial loans often give quick acceptance and funding, often within the similar working day. Small Credit history Specifications: For the reason that personal loan is secured by your automobile, credit rating checks may very well be considerably less stringent. Ongoing Vehicle Use: Borrowers can proceed driving their motor vehicle throughout the bank loan expression.

How On-line Title Financial loans Function

Applying for a title loan online simplifies the procedure, permitting you to complete the application from your convenience of your house. This is a basic overview of the actions associated:

Software Submission: Supply particulars about your self and also your car as a result of a web based type. - Documentation Review: Submit needed files, including your vehicle's title, proof of cash flow, and identification.

- Acceptance System: Lenders assess your software and determine the bank loan amount of money according to your car's benefit.

Getting Funds: Upon acceptance, funds are disbursed, normally by means of immediate deposit or Examine. Repayment Terms: Repay the bank loan as agreed, preserving in mind the desire rates and costs related.

Title Financial loans in Texas

Texas citizens searching for

Title Loans in Wisconsin

In Wisconsin, getting a

Title Loans in Tennessee

Tennessee inhabitants thinking about

Great things about On the net Title Loans

Picking an internet based title bank loan offers quite a few strengths:

Advantage: Utilize from wherever with no need to have to go to a physical site. Speed: Quick approval and funding processes. Accessibility: Accessible to men and women with several credit rating histories, presented they individual a qualifying car or truck.

Things to consider Ahead of Making use of

Just before proceeding which has a title financial loan, look at the next:

Desire Premiums: Title financial loans can have increased interest costs in comparison with traditional loans. Repayment Conditions: Ensure you can meet up with the repayment program to prevent opportunity repossession of one's car or truck.Mortgage Volume: Borrow only what you'll need and might afford to pay for to repay.

Summary

Title financial loans can be a practical Answer for anyone wanting speedy dollars, specially when regular credit rating avenues are unavailable. By comprehension the process and punctiliously considering the phrases, you can make an educated final decision that aligns with the fiscal wants. title loans online For more information and to use, pay a visit to OnlineTitleLoans.co.

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Sydney Simpson Then & Now!

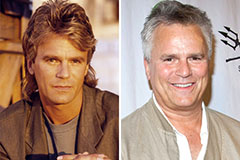

Sydney Simpson Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!