Here is the website URL: OnlineTitleLoans.co. This System offers a streamlined process for acquiring

Comprehension Title Loans

Fast Entry to Money: Title loans often provide fast acceptance and funding, from time to time throughout the exact working day. Minimum Credit rating Prerequisites: Since the personal loan is secured by your motor vehicle, credit checks may very well be fewer stringent. Ongoing Motor vehicle Use: Borrowers can continue driving their auto over the financial loan term.

How On the net Title Financial loans Do the job

Making use of for just a

Application Submission: Provide facts about your self and your car or truck by way of a web based variety. Documentation Overview: Post vital files, for example your vehicle's title, proof of revenue, and identification. Acceptance Method: Lenders evaluate your software and identify the loan amount dependant on your motor vehicle's worth.Acquiring Money: Upon acceptance, cash are disbursed, often by way of direct deposit or Verify. Repayment Terms: Repay the personal loan as agreed, keeping in mind the desire premiums and fees involved.

Title Loans in Texas

Texas people trying to find

Title Loans in Wisconsin

In Wisconsin, acquiring a

Title Financial loans in Tennessee

Tennessee people thinking about

Benefits of Online Title Loans

Picking a web based title bank loan offers numerous pros:

Benefit: Implement from anywhere without the want to go to a Bodily locale. - Speed: Speedy acceptance and funding procedures.

Accessibility: Accessible to people today with numerous credit histories, offered they possess a qualifying motor vehicle.

Considerations Prior to Implementing

Right before proceeding having a title loan, contemplate the following:

Fascination Costs: Title loans may have larger interest rates in comparison to traditional financial loans.- Repayment Terms: Ensure you can meet up with the repayment routine to stay away from probable repossession of one's motor vehicle.

Financial loan Amount of money: Borrow only what you'll need and may manage to repay.

Conclusion

Title loans can be quite a feasible Option for those looking for quick money, especially when conventional credit avenues are unavailable. By comprehending the process and punctiliously contemplating the conditions, you may make an informed decision that aligns together with your economic needs. For more info and to use, pay title loans online a visit to OnlineTitleLoans.co.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Erik von Detten Then & Now!

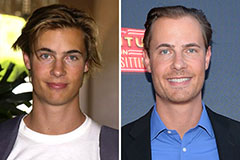

Erik von Detten Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!