Here is the website URL: OnlineTitleLoans.co. This System offers a streamlined method for obtaining

Being familiar with Title Loans

- Speedy Entry to Cash: Title loans generally supply swift acceptance and funding, from time to time inside the exact same day.

Minimum Credit rating Requirements: Because the financial loan is secured by your vehicle, credit checks could possibly be a lot less stringent. Continued Car Use: Borrowers can proceed driving their vehicle during the mortgage term.

How On the net Title Financial loans Perform

Implementing for just a title loan on-line simplifies the procedure, allowing you to complete the application from your convenience of your private home. This is a typical overview of your methods associated:

Application Submission: Deliver information about yourself and also your automobile through a web-based kind.Documentation Evaluation: Submit important files, including your motor vehicle's title, proof of cash flow, and identification. - Approval Course of action: Lenders assess your application and identify the financial loan amount of money based on your auto's price.

Receiving Resources: Upon acceptance, cash are disbursed, normally by using immediate deposit or Test.Repayment Terms: Repay the bank loan as agreed, preserving in mind the desire premiums and fees involved.

Title Loans in Texas

Texas citizens looking for

Title Financial loans in Wisconsin

In Wisconsin, getting a

Title Loans in Tennessee

Tennessee inhabitants thinking about

Advantages of On the internet Title Financial loans

Choosing an online title financial loan gives several pros:

Comfort: Apply from any where without the want to go to a physical site. Velocity: Brief approval and funding processes. - Accessibility: Accessible to individuals with different credit histories, presented they own a qualifying automobile.

Criteria Prior to Applying

Ahead of proceeding by using a title personal loan, contemplate the next:

Fascination Charges: Title loans might have better desire fees in comparison to conventional financial loans. Repayment Terms: Ensure you can meet the repayment program in order to avoid possible repossession of your respective motor vehicle. - Financial loan Amount: Borrow only what you'll need and might afford to repay.

Conclusion

Title financial loans can be a feasible Option for those needing swift hard cash, especially when standard credit score avenues are unavailable. By knowledge the procedure and punctiliously contemplating the conditions, you can also make an informed decision that aligns with all your fiscal needs. For tennessee title loans more info and to apply, stop by OnlineTitleLoans.co.

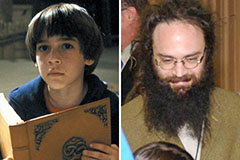

Barret Oliver Then & Now!

Barret Oliver Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!