Here's the web site URL: OnlineTitleLoans.co. This System offers a streamlined method for obtaining title financial loans on-line, catering to people in many states, which include Texas, Wisconsin, and Tennessee. Irrespective of whether you happen to be going through unexpected charges or searching for quick dollars, knowing the nuances of title financial loans can empower you to produce educated economic decisions.

Comprehending Title Financial loans

Quick Entry to Money: Title financial loans normally provide fast approval and funding, at times in the similar working day. Minimal Credit Specifications: Because the mortgage is secured by your automobile, credit score checks could possibly be considerably less stringent. Continued Automobile Use: Borrowers can go on driving their motor vehicle in the personal loan time period.

How On line Title Financial loans Operate

Applying for a

Software Submission: Deliver specifics about oneself and your car or truck via an online sort.- Documentation Critique: Post necessary paperwork, which include your automobile's title, evidence of income, and identification.

Acceptance Procedure: Lenders evaluate your application and decide the financial loan quantity determined by your vehicle's value.Acquiring Resources: On acceptance, resources are disbursed, often by way of direct deposit or Test. Repayment Conditions: Repay the loan as agreed, retaining in mind the fascination premiums and costs involved.

Title Financial loans in Texas

Texas people seeking

Title Loans in Wisconsin

In Wisconsin, obtaining a

Title Financial loans in Tennessee

Tennessee people considering

Advantages of On the net Title Financial loans

Deciding on a web based title financial loan delivers many rewards:

Usefulness: Apply from anyplace with no will need to visit a physical location. Pace: Fast acceptance and funding processes. Accessibility: Accessible to folks with numerous credit history histories, furnished they very own a qualifying car.

Considerations In advance of Applying

Before proceeding with a title financial loan, contemplate the subsequent:

Interest Costs: Title loans might have better desire charges compared to classic financial loans. Repayment Conditions: Ensure you can satisfy the repayment program to prevent opportunity repossession of one's car or truck. - Mortgage Total: Borrow only what you may need and will afford to repay.

Conclusion

Title loans generally is a practical solution for all those needing speedy hard cash, especially when conventional credit score avenues are unavailable. By comprehension the procedure and punctiliously considering the conditions, you can also make an educated choice that aligns along with your fiscal demands. To title loand wisconsin learn more and to apply, check out OnlineTitleLoans.co.

Yasmine Bleeth Then & Now!

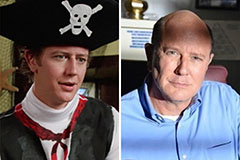

Yasmine Bleeth Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!